Bitcoin's starting price is a topic of interest for many investors and enthusiasts looking to understand the origins of the popular cryptocurrency. To shed light on this subject, we have curated a list of four articles that delve into the history and factors influencing Bitcoin's initial price. From discussions on the first recorded transaction to the impact of market demand, these articles provide valuable insights into the beginnings of Bitcoin's journey in the world of digital currencies.

Bitcoin has seen extreme fluctuations in price since its inception, with both highs and lows capturing the attention of investors and enthusiasts alike. In order to understand the lowest price of bitcoin, it is important to explore various factors that have contributed to its price history. The following articles delve into the topic, providing insights and analysis on the lowest price points of bitcoin and the events surrounding them.

Today we have with us a cryptocurrency expert who will shed some light on the recent dip in Bitcoin's price. Can you tell us what factors may have contributed to Bitcoin hitting its lowest price point in recent months?

Expert: Certainly. One of the key factors behind Bitcoin's lowest price point is the overall market sentiment. We have seen a lot of fear and uncertainty in the global economy, which has led investors to move away from riskier assets like Bitcoin. Additionally, regulatory crackdowns in certain countries have also played a role in driving down the price of Bitcoin.

Another important factor to consider is the impact of environmental concerns on Bitcoin mining. The growing awareness of the carbon footprint of Bitcoin mining has led to a shift towards more sustainable cryptocurrencies, which has affected Bitcoin's price negatively.

Overall, a combination of market sentiment, regulatory pressures, and environmental concerns have all contributed to Bitcoin's recent price decline.

This article is important for the topic of cryptocurrency as it provides valuable insights into the various factors that can influence the price of Bitcoin. By understanding these factors, investors and enthusiasts can make more informed decisions when it comes to trading or holding Bitcoin.

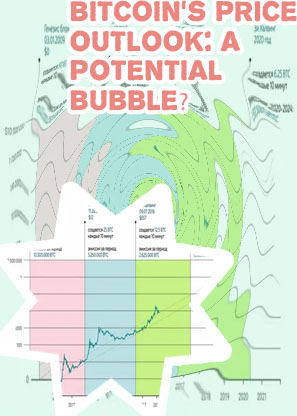

In the world of cryptocurrency, Bitcoin has established itself as a dominant player with its volatile price movements. One key aspect that investors and enthusiasts often look at is the price bottoms that Bitcoin has experienced throughout its history. By analyzing historical data, we can gain valuable insights into the patterns and trends that have emerged over time.

One interesting observation is that Bitcoin has experienced several significant price bottoms since its inception. For example, in 2011, Bitcoin hit a low of around

Bitcoin's price floor is influenced by a variety of external events that can have a significant impact on its value. These events can range from regulatory developments to macroeconomic trends, and can often lead to fluctuations in the price of the cryptocurrency. One key external event that has a major impact on Bitcoin's price floor is regulatory news. For example, announcements of new regulations or crackdowns on cryptocurrency exchanges can cause the price of Bitcoin to drop as investors fear increased scrutiny and potential restrictions on trading.

Another important external event that can affect Bitcoin's price floor is macroeconomic news. Economic indicators such as inflation rates, interest rates, and geopolitical tensions can all have an impact on the value of Bitcoin. For example, during times of economic uncertainty, investors may turn to Bitcoin as a safe haven asset, driving up its price.

Overall, it is important for investors and traders to stay informed about external events that can impact Bitcoin's price floor. By keeping an eye on regulatory developments, macroeconomic trends, and other key events, investors can make more informed decisions about when to buy, sell, or hold onto their Bitcoin holdings.

This topic is important and necessary for anyone who is interested in investing in Bitcoin or other cryptocurrencies. Understanding how external events can influence the price of Bitcoin is crucial for making informed

after a rapid increase in price. Similarly, in 2015, Bitcoin reached a bottom of approximately 0 following a sharp decline.Another important aspect to consider is the duration of these price bottoms. In many cases, Bitcoin has taken several months to recover from these lows and start a new upward trend. This highlights the importance of patience and long-term vision when investing in Bitcoin.

Overall, studying Bitcoin's price bottoms can provide valuable insights for investors looking to make informed decisions. By understanding the historical patterns and trends, investors can better navigate the volatile nature of the cryptocurrency market and potentially capitalize on opportunities for growth.

This article is important for the topic of cryptocurrency investing as it sheds light on the historical price movements of Bitcoin. By examining past price bottoms, investors can gain a better understanding of the market dynamics and

Bitcoin, the world's most popular cryptocurrency, has experienced significant fluctuations in value over the years. One of the key factors influencing these fluctuations is market conditions. In recent years, Bitcoin has seen some of its lowest values, and analyzing the market conditions leading to these lows can provide valuable insights for investors and enthusiasts alike.

One of the main reasons for Bitcoin's lowest values can be attributed to market sentiment. Negative news surrounding regulations, security breaches, and market manipulation can create fear and uncertainty among investors, leading to a sell-off and driving the price down. Additionally, market saturation and increased competition from other cryptocurrencies can also contribute to a decrease in Bitcoin's value.

Furthermore, macroeconomic factors such as global economic instability, inflation, and geopolitical tensions can impact the value of Bitcoin. During times of economic uncertainty, investors may seek safe-haven assets like gold or government bonds, causing a decline in demand for riskier assets like cryptocurrencies.

By analyzing the market conditions leading to Bitcoin's lowest value, investors can better understand the factors influencing its price movements and make informed decisions. This information is crucial for anyone looking to navigate the volatile world of cryptocurrency trading and investment.

Bitcoin's price floor is influenced by a variety of external events that can have a significant impact on its value. These events can range from regulatory developments to macroeconomic trends, and can often lead to fluctuations in the price of the cryptocurrency. One key external event that has a major impact on Bitcoin's price floor is regulatory news. For example, announcements of new regulations or crackdowns on cryptocurrency exchanges can cause the price of Bitcoin to drop as investors fear increased scrutiny and potential restrictions on trading.

Another important external event that can affect Bitcoin's price floor is macroeconomic news. Economic indicators such as inflation rates, interest rates, and geopolitical tensions can all have an impact on the value of Bitcoin. For example, during times of economic uncertainty, investors may turn to Bitcoin as a safe haven asset, driving up its price.

Overall, it is important for investors and traders to stay informed about external events that can impact Bitcoin's price floor. By keeping an eye on regulatory developments, macroeconomic trends, and other key events, investors can make more informed decisions about when to buy, sell, or hold onto their Bitcoin holdings.

This topic is important and necessary for anyone who is interested in investing in Bitcoin or other cryptocurrencies. Understanding how external events can influence the price of Bitcoin is crucial for making informed