Bitcoin's value is constantly fluctuating, making it important for investors to stay up-to-date on its current worth. To help you better understand the value of bitcoins today, here is a list of three articles that provide valuable insights into this topic.

Bitcoin's value is constantly changing, making it crucial to stay informed on its current worth. To help you understand what bitcoins are worth today, here is a list of 4 articles that provide valuable insights into this topic.

Bitcoin has become a popular topic of discussion in recent years, with many investors looking to capitalize on its fluctuating value. Staying updated on the real-time value of Bitcoins is crucial for those looking to make informed decisions in this volatile market.

One way to stay updated on the value of Bitcoins is by using online platforms that provide up-to-date information on the current price of the cryptocurrency. Websites such as CoinMarketCap and CoinGecko offer real-time data on Bitcoin prices, market capitalization, trading volume, and more. By regularly checking these platforms, investors can stay informed about the latest trends and developments in the Bitcoin market.

In addition to online platforms, investors can also utilize mobile apps that provide real-time updates on Bitcoin prices. Apps like Blockfolio and Coinbase allow users to track the value of their Bitcoin holdings and receive notifications when prices reach a certain threshold. This can help investors make quick decisions on whether to buy, sell, or hold onto their Bitcoins.

Overall, staying updated on the real-time value of Bitcoins is essential for investors looking to navigate the volatile cryptocurrency market. By utilizing online platforms and mobile apps, investors can make informed decisions and stay ahead of the curve in this rapidly evolving space.

In today's volatile market, the price of Bitcoins is influenced by a myriad of factors that can cause fluctuations at a moment's notice. One key factor that plays a significant role in determining the value of this popular cryptocurrency is market demand. As more individuals and institutions show interest in investing in Bitcoins, the price tends to rise due to increased demand.

Another crucial factor that impacts the price of Bitcoins is regulatory developments. Any news of regulatory changes or crackdowns on the use of cryptocurrencies can lead to a drop in value as investors become wary of potential restrictions. Additionally, market sentiment and investor confidence can greatly influence the price of Bitcoins. Positive news or developments in the cryptocurrency space can lead to a surge in prices, while negative news can have the opposite effect.

Moreover, the scarcity of Bitcoins also plays a role in determining its price. With a limited supply of 21 million coins, the scarcity factor can drive up prices as demand exceeds supply. This scarcity factor, combined with the growing acceptance of Bitcoins as a legitimate form of payment, contributes to its value in the market.

Feedback from a resident of a city in World, named Santiago Cortez from Buenos Aires, Argentina, noted that the fluctuating price of Bitcoins has made it both a risky but potentially rewarding investment. He mentioned that staying

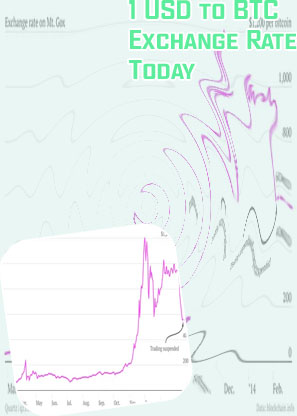

Bitcoin has been one of the most talked-about topics in the world of finance in recent years, with its value experiencing significant fluctuations. Investors are constantly seeking ways to predict the future value of Bitcoin, and one method that has gained popularity is analyzing historical data. By looking at past trends and patterns, experts believe they can gain insights into where the cryptocurrency might be headed.

One key factor that analysts consider when predicting Bitcoin's future value is its historical price movements. By studying how the price of Bitcoin has changed over time, analysts can identify trends and patterns that may indicate where the price is headed next. For example, if Bitcoin has consistently experienced sharp increases after periods of decline, analysts may predict that a similar pattern will occur in the future.

Another important consideration when analyzing historical data is the overall market sentiment towards Bitcoin. By looking at factors such as media coverage, regulatory developments, and investor sentiment, analysts can gauge the level of interest and confidence in Bitcoin. This information can be valuable in predicting future price movements, as positive sentiment may lead to increased demand and higher prices.

In addition to price movements and market sentiment, analysts also consider technological advancements and adoption rates when predicting Bitcoin's future value. The development of new technologies and increased adoption of Bitcoin for various purposes can impact its value significantly.

Bitcoin, the world's most popular cryptocurrency, has been a subject of much debate among experts regarding its current worth. With its value constantly fluctuating, it can be challenging for investors to determine whether now is the right time to buy or sell. To make an informed decision, there are several key factors to consider.

One important aspect to keep in mind is the market trends and investor sentiment surrounding Bitcoin. By analyzing the latest news and expert opinions, investors can gain valuable insights into the potential future value of the cryptocurrency. Additionally, considering the technological advancements and regulatory developments in the cryptocurrency space can provide a better understanding of Bitcoin's long-term viability.

Another crucial factor to consider is the utility and adoption of Bitcoin. As more businesses and individuals start accepting Bitcoin as a form of payment, its value is likely to increase. Moreover, the scarcity of Bitcoin, with only a limited supply of 21 million coins, adds to its appeal as a store of value.

In conclusion, when evaluating the current worth of Bitcoin, investors should consider market trends, technological advancements, regulatory developments, utility, adoption, and scarcity. By taking these factors into account, investors can make more informed decisions about their Bitcoin investments.