Interested in investing in Ethereum stock but not sure where to start? Look no further! Below are three articles that will provide you with valuable information and insights into the world of Ethereum stock. Whether you're a beginner looking to dip your toes into the market or a seasoned investor wanting to diversify your portfolio, these articles will help guide you in the right direction.

Investors are constantly seeking ways to predict and understand the fluctuations in the Etherium stock price. By staying informed on the latest news and trends in the cryptocurrency market, investors can make more informed decisions on when to buy or sell their Etherium stocks. To help with this, we have compiled a list of 3 articles that provide valuable insights into the factors influencing the Etherium stock price.

The recent regulatory changes in the cryptocurrency market have had a significant impact on the price of Etherium. As governments around the world continue to grapple with how to regulate digital assets, investors are closely monitoring how these changes will affect the value of their holdings.

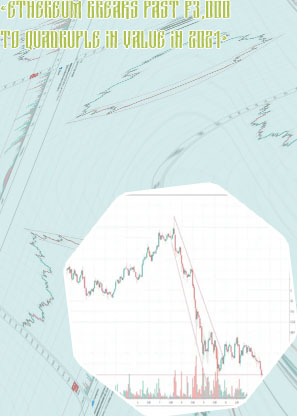

One of the key factors driving the fluctuations in Etherium's stock price is the uncertainty surrounding regulatory oversight. As regulators crack down on crypto exchanges and tighten restrictions on trading, investors are left wondering how these changes will impact the overall market. This uncertainty has led to increased volatility in Etherium's price, with sharp swings in both directions becoming more common.

In addition to regulatory concerns, market sentiment and investor behavior also play a role in determining Etherium's stock price. As news of regulatory changes spreads, investors may panic and sell off their holdings, leading to a drop in price. Conversely, positive news or developments in the space can drive up the price as investors rush to buy in.

Moving forward, it will be important for investors to closely monitor regulatory developments and market sentiment in order to make informed decisions about their Etherium holdings. By staying informed and being prepared to adapt to changing market conditions, investors can navigate the volatile cryptocurrency market with confidence.

In the ever-changing world of cryptocurrency trading, market sentiment plays a crucial role in influencing the price movements of assets like Ethereum. As investors and traders gauge the overall mood and attitude of the market, they make decisions that can either drive up or bring down the value of Ether. Understanding how market sentiment affects Ethereum stock price can provide valuable insights for those looking to navigate the volatile crypto market.

One key factor to consider when analyzing market sentiment is the impact of social media and news outlets on investor perception. Positive or negative news about Ethereum, whether it's related to technological advancements, regulatory developments, or market trends, can significantly sway market sentiment and subsequently influence its stock price.

Additionally, investor behavior and market psychology are essential aspects to consider when evaluating market sentiment. Fear, greed, optimism, and pessimism are common emotions that drive market participants to buy or sell Ether, leading to price fluctuations that can be attributed to sentiment-driven decisions.

Moreover, market sentiment indicators such as the Fear and Greed Index, social media sentiment analysis tools, and surveys can help investors gauge the overall mood of the market and make informed trading decisions based on sentiment analysis.

In conclusion, market sentiment is a powerful force that can impact the price of Ethereum stock. By understanding and analyzing market sentiment, investors can gain a

In the fast-paced world of cryptocurrency, technological developments play a crucial role in influencing the stock price of popular digital currencies such as Ethereum. Investors and traders closely monitor advancements in technology to gauge the potential impact on the market value of Ethereum and other cryptocurrencies. These developments can range from software upgrades, security improvements, scalability solutions, to partnerships with major companies.

One practical use case of evaluating technological developments on Ethereum stock price is the implementation of Ethereum 2.0, also known as Serenity. This major upgrade aims to improve the scalability, security, and sustainability of the Ethereum network, which in turn can attract more investors and increase the overall value of Ethereum. As a result of the successful rollout of Ethereum 2.0, the stock price of Ethereum experienced a significant increase, rewarding early investors and traders who had the foresight to anticipate the positive impact of this technological development.

Overall, staying informed about technological developments in the cryptocurrency space is essential for making informed investment decisions. By understanding how advancements in technology can influence the stock price of Ethereum, investors can better position themselves to capitalize on opportunities and maximize profits in this volatile yet potentially rewarding market.